Case Studies

Utilizing Predictive Analytics to Improve Appeal Success Rates

Accelerating Cash Flow & Improving Reimbursement Rates with Predictive Analytics in Healthcare

Client’s Challenge

Increasing Revenue and Client Reimbursement Rates

Our client wanted to refine its ability to recover underpaid zero balance claims, providing additional reimbursement faster for its clients.

Our Solution

Development of a Statistical Model

Through rigorous, exploratory analysis, our team developed a predictive model to identify which appeals would result in a successful outcome. We then crafted a final model that emphasized simplicity by maintaining a balance between the multiple parameters that impact an appeal outcome.

Value Realized

Increased Successful Appeals & Accelerated Cash Flow

InfoWorks delivered a model that allows our client to prioritize working appeals with the highest likelihood of a successful outcome. Specialized features allow prioritization of high-value claims and faster payments to cash-sensitive clients. Our team built the model with foresight, allowing our client to scale with growth.

Project Details

Our client, the nation’s leading workers’ compensation (WC) reimbursement expert who has processed over $1B+ in WC claims for over 500 health systems and hospitals nationwide, recently partnered with InfoWorks to research additional analytics-based methods and predictive analytics tools to further enhance its appeal success rates on zero balance claims. A zero balance claim is a claim the member pays for in its entirety, typically because the cash price is lower than copay.

The complexity of WC and its variations in reimbursement because of state-specific fee schedules makes efficient, expedient claims processing and timely reimbursement a challenge. With its proprietary technology platform, Enforcer, our client is a valuable resource to healthcare organizations who do not have the expertise on hand to navigate through the reimbursement process.

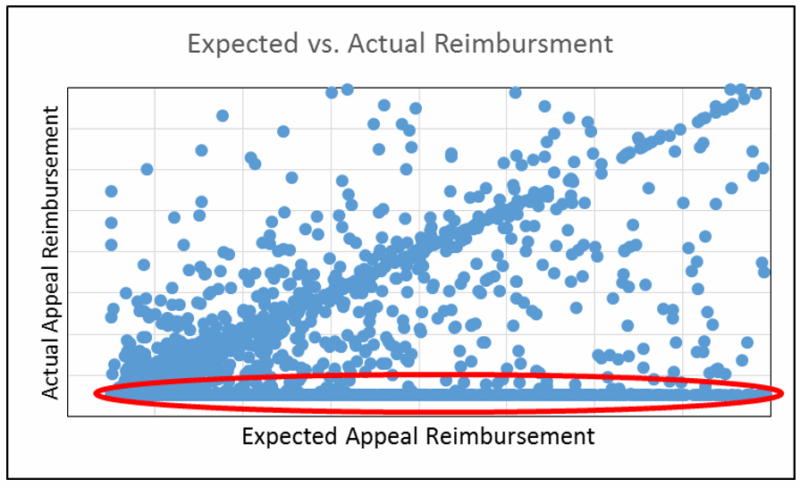

Our client wanted to provide additional reimbursement faster for its clients by recovering underpaid zero balance claims. Beginning with a thorough exploratory analysis, we developed a statistical model to accurately predict which appeals would result in a successful outcome. The overall goal was to inform decisions about the priority order for all underpaid claims, leading to the maximum amount of returns in the shortest time possible for clients.

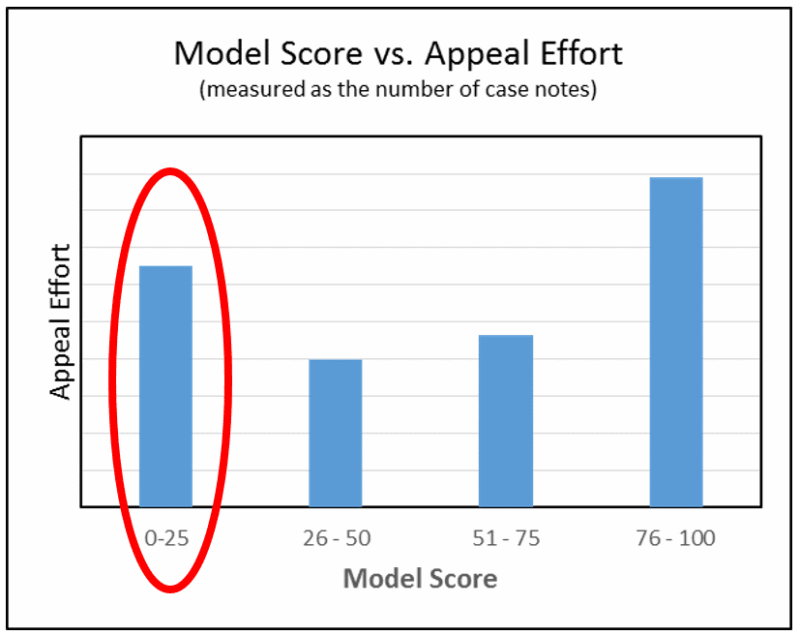

Our team began by performing a survey of what attributes are known before the appeals process begins. This includes information about the patient, the procedures performed, the payer, supporting documentation, and the claim’s payment history. We then pulled together multiple years of data outlining past appeals and performed an advanced analytics analysis on each parameter to determine how much of a role it plays in predicting the outcome of an appeal.

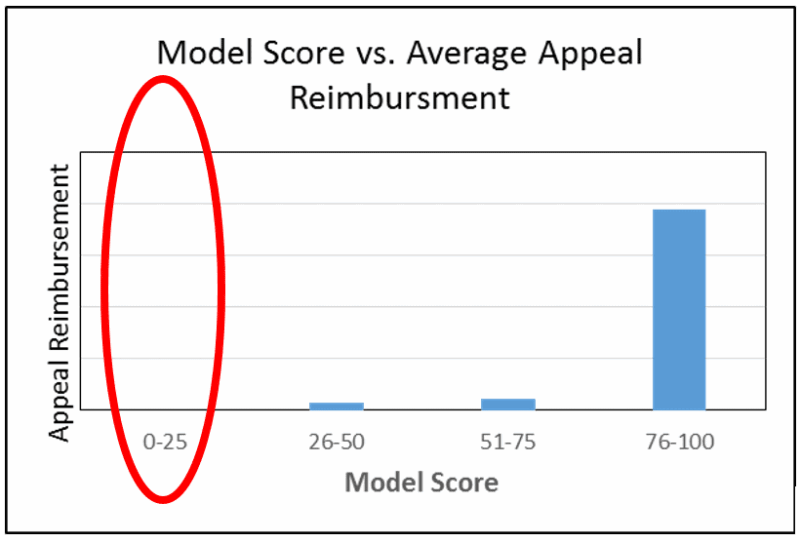

Through this comprehensive analysis, we crafted a final predictive algorithm that emphasized simplicity by maintaining a balance between the multiple parameters that impact an appeal outcome. That simplicity appeared as a score that reveals the likelihood each appealed claim would be successful. Success was defined by both the probability that a reimbursement will be made by the payer and the amount of the reimbursement. Not only does the score account for multiple important factors, it simplifies it so that everyone in the organization can understand its impact and have the clarity needed for better decision making. The model was able to score the claims used in the test population with a high degree of accuracy.

What’s the value to our client going forward?

With the new predictive model, our client can prioritize appeals with the best chance of a successful outcome. In addition, the model:

- Can be perfected over time as their client base and data set expands

- Accelerates cash flow to its cash-sensitive clients and supports the effort to deliver maximum recovered underpayments as fast as possible

- Provides additional reimbursement uplift to their clients

- Offers employees an additional tool which allows them to focus on the most valuable claims with the highest return first – leading to improved outcomes.